Table of Contents

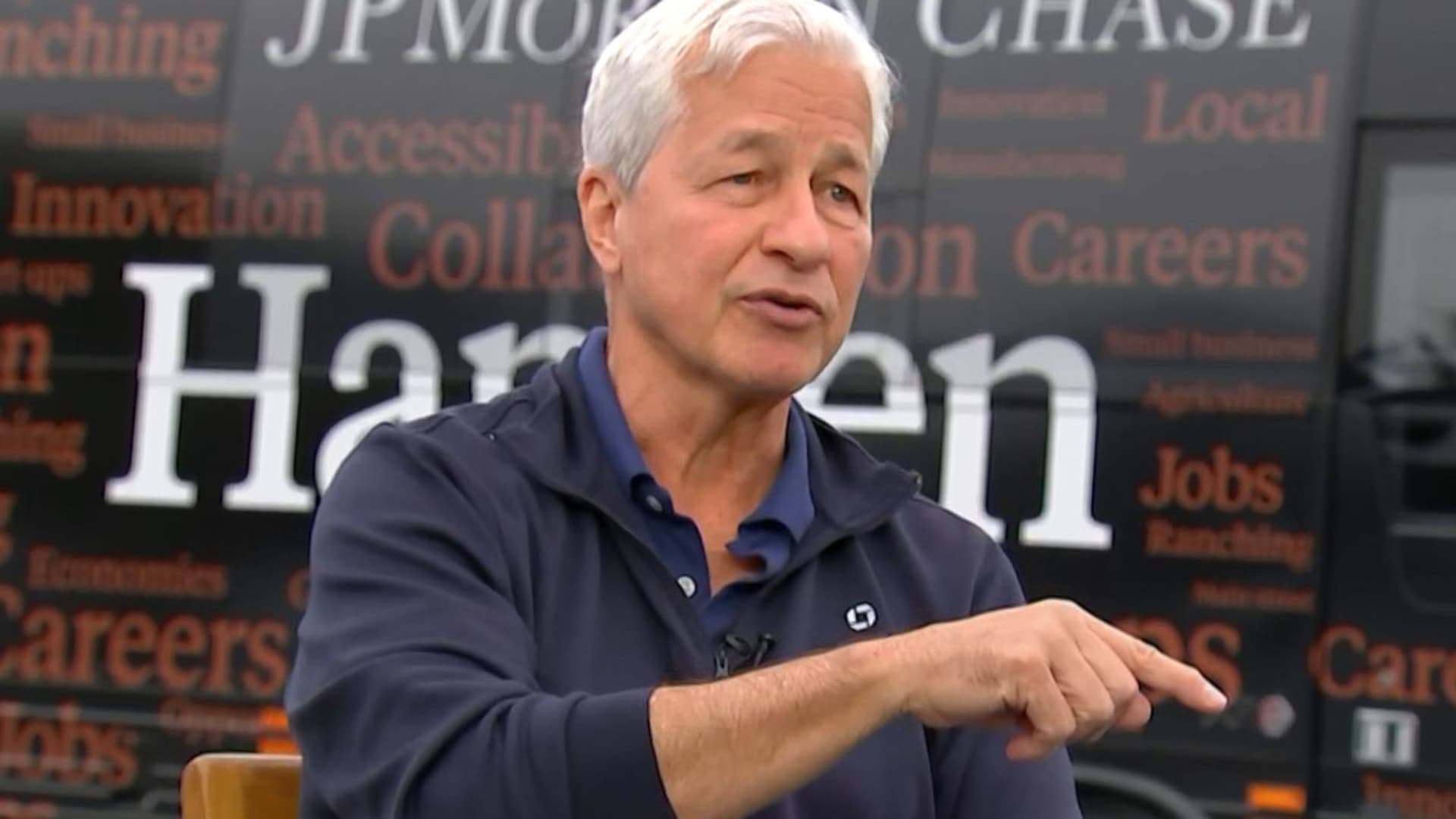

- Jamie Dimon urges 'faith' and 'patience' amid election uncertainty

- Jamie Dimon

- JPMorgan's Jamie Dimon Should Be Worried About Shadow Banking - Bloomberg

- Jamie Dimon slams anti-return to office petitioners | Fox Business

- Bitcoin Critic Jamie Dimon on AI - “This is Not Hype. This is Real"

- Is Jamie Dimon Jewish? Uncovering The Facts

- Jamie Dimon rattled the markets last year by comparing the coming ...

- Jamie Dimon to sell 1 million shares of JPMorgan - FeeOnlyNews.com

- JPMorgan Chase holds Jamie Dimon’s annual pay steady at .5m ...

- Exclusive | Why Jamie Dimon is quietly clamping down on remote work at ...

Dimon's comments come at a time when the world is grappling with a multitude of challenges, including the ongoing Ukraine-Russia conflict, rising income inequality, and the lingering effects of the COVID-19 pandemic. These factors have created a perfect storm of uncertainty, making it difficult for economists and policymakers to predict what's next.

Key Drivers of Geopolitical Uncertainty

- Rising Nationalism: The resurgence of nationalist sentiment in countries around the world is leading to increased protectionism and trade tensions.

- Global Power Shifts: The ongoing shift in global power dynamics, with the rise of countries like China and India, is creating new challenges for established economies.

- Cybersecurity Threats: The increasing threat of cyberattacks and data breaches is a major concern for businesses and governments alike.

- Climate Change: The growing awareness of climate change and its impact on the environment is leading to increased calls for action and potential disruptions to traditional industries.

Impact on the Global Economy

The International Monetary Fund (IMF) has downgraded its forecast for global economic growth, citing the ongoing trade tensions and geopolitical uncertainty. This has led to increased volatility in financial markets, with investors becoming increasingly risk-averse.

In addition, the uncertainty is affecting business confidence, with many companies delaying investment decisions or putting plans on hold until the outlook becomes clearer. This, in turn, is having a knock-on effect on employment and consumer spending, which are critical drivers of economic growth.

Navigating the Challenges Ahead

While the current geopolitical landscape is undoubtedly challenging, there are steps that individuals, businesses, and governments can take to navigate these treacherous waters. Some potential strategies include:- Diversification: Spreading investments across different asset classes and geographies can help reduce exposure to any one particular market or region.

- Scenario Planning: Developing scenarios for different potential outcomes can help businesses and governments prepare for a range of possibilities.

- Investing in Education and Training: Upskilling and reskilling workers can help them adapt to changing economic conditions and stay competitive in a rapidly evolving job market.

In conclusion, the current geopolitical uncertainty is a major challenge for the global economy. However, by understanding the key drivers of this uncertainty and taking proactive steps to navigate the challenges ahead, we can work towards creating a more stable and prosperous future for all.

Note: This article is for general information purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.